Here is a complete Helsana review for medical insurance in Switzerland. We analyzed the company Helsana and the services that are provided, to give you an overview of what Helsana has to offer.

The Helsana Group is one of the leading Swiss health insurance companies. Helsana Group is the fastest growing health insurance company in terms of basic insurance policyholders.

The company offers basic, supplementary, and accident insurance nationwide. With Helsana’s voluntary supplementary insurances, insurance coverage can be individually adapted to your own needs. For this purpose, you can also choose between alternative variants such as the family doctor model, telemedicine, or a telephone consultation hotline for basic insurance. Individually tailored insurance packages are offered for cross-border commuters and newborns.

Helsana health insurance premiums

With Helsana health insurance, you will pay an average of CHF 428 per month, if you opt for the standard model with accident coverage and a 300 deductible. This means that health insurance premiums will decrease compared to the previous year. However, depending on where you live, health insurance premiums can also be significantly lower or higher.

In the premium region of Appenzell Innerrhoden, for example, you pay CHF 346 for basic health insurance, while in Geneva it’s CHF 623 per month.

In the cantons of Bern, Basel-Landschaft and Jura, Helsana is the cheapest health insurance company. In Appenzell Innerrhoden and Glarus, it is among the cheapest.

Overall, at CHF 428, Helsana Health Insurance is well below the average premium for Switzerland as a whole of CHF 486 (for the standard model with 300 deductible and accident coverage).

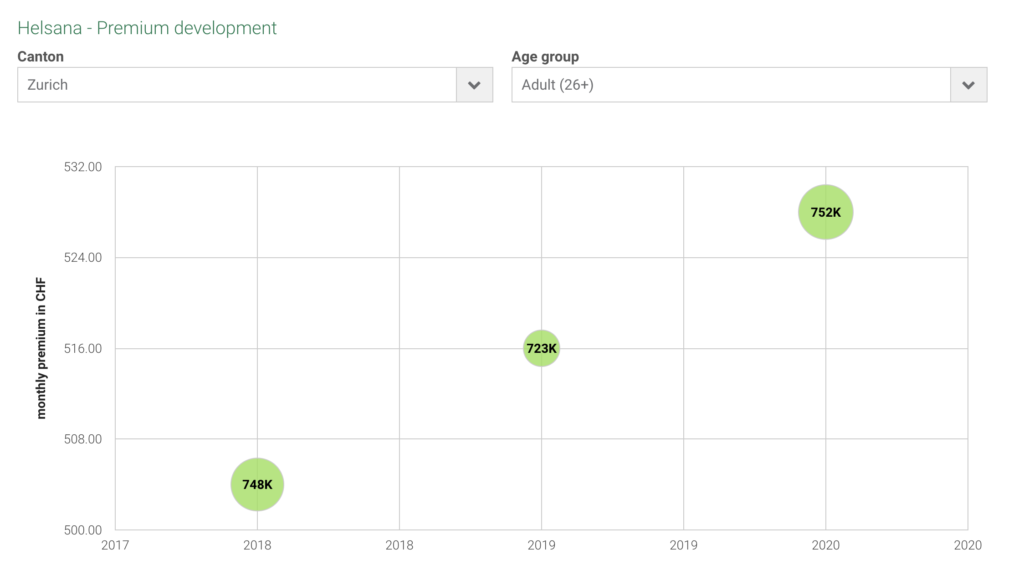

Premium development of Helsana Health Insurance

In addition to the benefits offered, the development of premiums is an important criterion when deciding on a health insurance company. Helsana health insurance premiums have risen continuously in recent years, as is the case with all health insurance companies.

Five years ago, Helsana’s average premium for basic insurance with a 300 deductible without accident coverage was CHF 420 per month. Until 2016, health insurance premiums rose sharply; in the last four years, the situation eased for Helsana policyholders. In 2020, the average premium was 440 francs.

In a 5-year comparison, this corresponds to an increase of only four percent. The Swiss average, on the other hand, is 16 percent.

What insurance models does Helsana offer?

In addition to the standard Basic model, Helsana Insurance offers three other insurance models in the area of basic insurance:

BeneFit Plus GP: With the GP model, insureds commit to seeing their chosen GP or HMO group practice first. By forgoing the free choice of doctor, they can save up to 12 percent on premiums.

BeneFit Plus Telmed: This model relies on telemedicine. This means that Helsana policyholders call the independent center for telemedicine in the first step when they have problems with their health (not Medgate, as was previously the case). There they receive advice over the phone and are referred to the appropriate physician. With BeneFit Plus Telmed, discounts of up to 15 percent of the premium are possible.

PreMed-24: Similar to the TelMed model, Helsana customers receive an initial medical assessment of their health condition via a free consultation hotline. Should this result in a visit to the doctor being necessary, patients can consult a specialist of their choice. Premium savings: up to 8 percent.

Helsana awards for customer satisfaction

In the Comparis Customer Satisfaction Survey 2022, more than 3,400 people from Switzerland rated their health insurance companies. Together with three other health insurers, Helsana is in fifth place with a rating of good (5.1). The quality and service of benefits, information, communication and transparency as well as the convenience of touchpoints and contacts were all given the grade good (5.1), and overall satisfaction even received the grade good (5.2). With scores of 4.6 and 4.9, innovation and value for money were found to be satisfactory.

Helsana supplementary insurance benefits

If you opt for a premium policy these are the benefits that Helsana offers.

Top” supplementary health insurance

The “Top” supplementary health insurance includes important outpatient services that are not covered, or only inadequately covered, by the mandatory basic insurance. For example, 90 percent of medicines are covered. For visual aids such as glasses and contact lenses, there is an annual allowance of up to CHF 150.

Special forms of treatment are also covered by the tariff. These include psychotherapy, sterilization, operations required due to obesity and breast surgery. Provided the treatment has been prescribed by a doctor, the insurer covers 75 percent of the costs up to a maximum of CHF 3,000 per calendar year. The limit applies to all special forms of treatment.

International health insurance is also included in the “Top” tariff. For treatment outside Switzerland, the additional costs are covered in full. Rescue and transport costs abroad are covered at 100 percent. As a special service, there is also foreign and health legal protection with an insured sum of CHF 250,000. All disputes with doctors, hospitals, social security, and private liability insurers are covered. The insurance covers attorney’s fees, court and procedural costs, expert opinions, court costs and party compensation.

“Sana” for alternative treatments

Holders of the “Sana” tariff can decide individually whether they wish to be treated in the traditional way or in an alternative way. The tariff includes valuable additional services from the areas of complementary medicine, prevention and health promotion. For outpatient alternative treatments, 75 percent and for inpatient stays 100 percent of the costs incurred are covered up to CHF 5,000 per calendar year. In addition, the insurer contributes a maximum of CHF 200 to health promotion and up to CHF 500 to preventive measures.

Primeo” supplementary health insurance

The supplementary health insurance “Primeo” offers comprehensive coverage for outpatient surgery. The tariff allows policyholders to choose their own doctor and offers numerous additional benefits such as high-quality implants, check-ups, innovative forms of diagnosis and treatment, and much more. Helsana pays an annual allowance of up to CHF 1,700 for preventive check-ups. If overnight stays are necessary due to an outpatient procedure, these are subsidized by up to CHF 1,200 per calendar year. For implants, Helsana covers 90 percent of the costs up to CHF 5,000.

Omnia” supplementary health and hospital insurance

The supplementary insurance “Omnia” offers the most important additional benefits for outpatient and inpatient treatment at an affordable price. Insured persons can change to a higher-value tariff every five years without a new health check. The supplementary insurance is particularly recommended for young policyholders who are looking for affordable all-round coverage and want to secure guaranteed upgrade and expansion options for the future.

Hospital supplementary insurance

Helsana Insurance offers a whole range of tariffs for inpatient hospital treatment. These include various additional services such as childcare, nanny service, home help or spa and recuperation treatments. Depending on the tariff, the costs for stays in a shared room, double room or single room are covered. Policies are also offered for daily hospital allowances and for people over 50.

“Dentaplus” for dental treatment

The “Dentaplus” tariff is offered in different variants and provides cost sharing for dental treatments, dental hygiene, check-ups, orthodontics and oral surgery. In the “Light” variant, Helsana covers 75 percent of the costs up to CHF 300 per calendar year. A maximum of up to CHF 3,000 per year can be reimbursed with the “Gold” tariff variant. If a cost contribution is made by school or youth dental care, our contribution is reduced accordingly.

Who can take out Helsana supplementary insurance?

Helsana’s supplementary insurances are offered to all persons with a permanent residence in Switzerland. In addition, a maximum age of 65 years applies at the start of insurance, or 49 years for the “Omnia” tariff. In order to assess the risk, a health declaration is carried out before the policy is taken out. Insurance coverage begins upon receipt of the positive acceptance notice.

Any waiting periods must be taken into account. With the “Top” tariff, for example, maternity benefits are only covered after a waiting period of 365 days. In the case of illness or accident, on the other hand, insurance cover is provided as soon as the policy is taken out. The “Dentaplus” tariff has a waiting period of six months.

Terms and notice periods for Helsana supplementary insurance

The minimum contract term is one year. If the contract is not terminated with three months’ notice as of December 31, it is automatically extended for another year. In the event of changes to the premium, a shortened notice period of one month applies. Multi-year contracts of three or five years can also be concluded on request. A notice period of six months applies to a five-year contract and five months to a three-year contract.

It should be noted that different terms are not possible. Therefore, all supplementary insurances must be concluded for the same term. Read more information about switching health insurers here.

Save with premium discounts

Helsana offers various savings options with its supplementary insurances. For multi-year contracts, there is a discount of three or five percent. Those who waive the integrated accident coverage receive a discount of ten percent. Accident coverage pays for benefits that are not covered by the employer’s mandatory accident insurance.

A family discount is also available with Helsana’s supplementary insurance plans. If two people from the same household are insured, the premium is reduced by five percent. If three people are insured, the policy is ten percent cheaper.

Anyone who combines the “Primeo” tariff with supplementary hospital insurance for inpatient hospital stays in the semi-private (2-bed room) or private ward (1-bed room) receives a discount of 20 or 30 percent on the monthly premium, depending on the variant.

Special Helsana insurance packages for cross-border commuters

Helsana offers insurance packages for German, French and Italian cross-border commuters.

Advantages of Helsana’s cross-border commuter insurance:

- Comprehensive all-round protection in Swiss quality

- Right to choose between treatment in Switzerland or in the home country

- Personal advice at cross-border commuter agencies

- The right supplementary insurance for your needs

- The basic insurance “Basis” covers the mandatory basic protection according to the Swiss Health Insurance Act (KVG). Basic care in case of illness, accident and maternity is thus covered.

The health insurance companies are obliged to accept every applicant without reservation, completely independent of age and personal state of health.

The “Completa” tariff offers comprehensive insurance cover for the most demanding requirements. It covers additional costs for complementary medicine, prevention and health promotion. For example, expenses for visual aids, medications not covered by health insurance and alternative treatment methods are covered on a pro-rata basis.

The “Eco” hospital insurance covers the general costs for accommodation in a shared room. Hospital stays in Switzerland are covered in full. For stays in Germany and the rest of the world, there is an allowance of CHF 500 per day for a period of up to 60 days per calendar year. In addition, expenses for household help or childcare are also subsidized.

Who can take out cross-border commuter insurance with Helsana?

Supplementary insurance for cross-border commuters can be taken out by all persons resident in an EU or EFTA country who are subject to the Swiss Health Insurance Act on the basis of the bilateral agreements. The contract for the “Basis” tariff generally runs for the entire duration of the cross-border commuter’s activity. If you wish to change to another insurance company, you can always terminate the contract with a notice period of three months as of June 30. It is also possible to terminate the contract with one month’s notice as of December 31. The contract ends automatically if the cross-border commuter stops working or becomes unemployed.

As with the other supplementary insurances, the “Completa” tariff has a minimum term of one year with the possibility of termination at the end of the year. Alternatively, multi-year contracts are also offered at more favorable conditions.

Conclusion Helsana

Helsana is a health insurer with some of the most satisfied customers. It offers individuals and companies a complete health and prevention service in the event of sickness and accident and in general, can be a good choice for you if you are new in Switzerland.

This was our review of Helsana, if you still want an extensive guide to the best health insurance in Switzerland click here.